The month is coming to an end, and the portfolio is hard at work attempting to snatch defeat from the jaws of victory. . Having been positive since inception towards the end of last week, the portfolio will now struggle to reach a positive October given the significant downturn in oil. Such is the danger of a relatively concentrated portfolio, and Macro Man looks forward to building out and diversifying risk in the months to come. As it stands, oil reminds Macro Man of British commuter trains; neither one can be counted on these days to perform as expected.

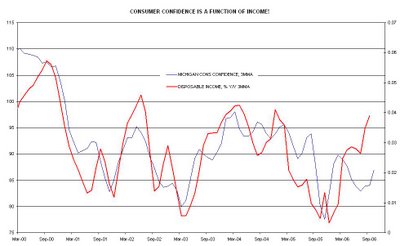

Elsewhere, the news that US incomes continue to rise at a healthy clip has received a collective yawn from bonds and currencies. So important is the housing market, evidently, that a sizeable boost to spending power from wages and lower utility bills is irrelevant. Never mind that consumer confidence is rebounding, or that the employment cost index rose 1% in Q3 for the first time in more than two years. Hmmmm. As the chart below indicates (or will indicate once Blogger lets Macro Man post images), consumer confidence has been highly correlated with disposable income growth in this millennium.

Macro Man trawled a few notable economics blogs over the weekend and was startled to discover the number of people expecting a 20% decline in house prices; indeed, many believed that the price data from the new home sales figures represented the actual decline in the value of the stock of US homes. Meanwhile, the OFHEO house price index, which uses data from mortgages for purchase AND refinancing, last showed a y/y gain in excess of 10% in Q2, which represents a material depreciation but nevertheless is comfortably positive. A further decline in the rate of appreciation would not be unprecedented in the least; note that this index showed house prices gains in the low to mid single digits for the entirety of the 1990’s. Should the US equity market correct lower, Macro Man will be sorely tempted to buy some longer dated low delta calls on the XHB homebuilder ETF.

Will the stock market correct? That is the million dollar question for hedge funds, real money, and EM investors. The consensus seems to suggest ‘yes’, particularly given that many recalcitrant shorts and hand sitters have been dragged into the market. CFTC data suggests that futures traders are net long. Indeed, Macro Man has been waiting for a further rally to scale into shorts. However, he is beginning to wonder if the pain trade isn’t SPX 1450 by the end of the year, as the market will surely try and set shorts > 1400. Perhaps more strangles are the way to go. More thought is required here.

Elsewhere, the BOJ left the door open for further tightening in the near term despite the predictable decline in the inflation forecast. Interestingly, a government official suggested that the BOJ would be unwise to tighten unless core CPI were at least 0.5% (currently 0.2%.) Meanwhile, the economy continues to shown signs of deceleration. The unemployment rate rose and household spending fell precipitously overnight, while industrial production has been essentially flat in Q3. Perhaps the myth of independent Japanese domestic demand remains just that. However, the situation bears watching. If both the Nikkei and JGB yields fall sharply, Macro Man believes that the yen will likely rally, in which case the $ call will perform poorly. A sale of EUR/JPY or CHF/JPY might be a useful hedge; stay tuned.

Elsewhere, the news that US incomes continue to rise at a healthy clip has received a collective yawn from bonds and currencies. So important is the housing market, evidently, that a sizeable boost to spending power from wages and lower utility bills is irrelevant. Never mind that consumer confidence is rebounding, or that the employment cost index rose 1% in Q3 for the first time in more than two years. Hmmmm. As the chart below indicates (or will indicate once Blogger lets Macro Man post images), consumer confidence has been highly correlated with disposable income growth in this millennium.

Macro Man trawled a few notable economics blogs over the weekend and was startled to discover the number of people expecting a 20% decline in house prices; indeed, many believed that the price data from the new home sales figures represented the actual decline in the value of the stock of US homes. Meanwhile, the OFHEO house price index, which uses data from mortgages for purchase AND refinancing, last showed a y/y gain in excess of 10% in Q2, which represents a material depreciation but nevertheless is comfortably positive. A further decline in the rate of appreciation would not be unprecedented in the least; note that this index showed house prices gains in the low to mid single digits for the entirety of the 1990’s. Should the US equity market correct lower, Macro Man will be sorely tempted to buy some longer dated low delta calls on the XHB homebuilder ETF.

Will the stock market correct? That is the million dollar question for hedge funds, real money, and EM investors. The consensus seems to suggest ‘yes’, particularly given that many recalcitrant shorts and hand sitters have been dragged into the market. CFTC data suggests that futures traders are net long. Indeed, Macro Man has been waiting for a further rally to scale into shorts. However, he is beginning to wonder if the pain trade isn’t SPX 1450 by the end of the year, as the market will surely try and set shorts > 1400. Perhaps more strangles are the way to go. More thought is required here.

Elsewhere, the BOJ left the door open for further tightening in the near term despite the predictable decline in the inflation forecast. Interestingly, a government official suggested that the BOJ would be unwise to tighten unless core CPI were at least 0.5% (currently 0.2%.) Meanwhile, the economy continues to shown signs of deceleration. The unemployment rate rose and household spending fell precipitously overnight, while industrial production has been essentially flat in Q3. Perhaps the myth of independent Japanese domestic demand remains just that. However, the situation bears watching. If both the Nikkei and JGB yields fall sharply, Macro Man believes that the yen will likely rally, in which case the $ call will perform poorly. A sale of EUR/JPY or CHF/JPY might be a useful hedge; stay tuned.