Yesterday was not much fun for Macro Man. After a solid close to the month last Friday, virtually every single position went wrong on Monday. Indeed, it was one of those days where Macro Man wished to erect a brick wall next to his desk so that he could bang his head against it throughout the day. As the title of this post suggests, patience is wearing thin.

Where to begin? The bond position started going wrong well before the US data dump, with the losses picking up steam after the release of a below consensus ISM report. Of course, both construction spending and pending home sales were higher than expected (and positive); given the degree to which the ‘US hits a brick wall’ bandwagon has hitched itself to the collapse of the housing market, one might have reasonably expected the bond market to sell off on the back of this relatively cheery news. Instead, markets appeared to react (or predict- more on this later) a below consensus ISM, with a particularly sharp decline in prices paid. Why anyone should be surprised that the price component of the survey fell after 25% declines in the prices of crude and gasoline is perhaps a question for a sage on top of a mountain; nevertheless, this provided a handy ex post rationale for the bond market rally.

But that’s not all that went wrong yesterday. The dollar sold off hard 45 minutes before the 3pm data fest, dragging even the lowly kiwi substantially higher. The contemporaneous explanation was a rumour of a sub-50 ISM (in which case, why didn’t the dollar and yields rally after the 52.9 release?), but it doesn’t really hold water. Rather, the real answer lies with that nemesis of foreign exchange traders everywhere: emerging market central banks. Ex post, it is quite clear that a number of central banks sold dollars in exchange for euros, sterling, and yen some 45 minutes before the US data dump. Why? Who knows, and there’s the rub with foreign exchange markets. They are being increasingly driven by central bank flows, which often appear to be fairly arbitrary in their timing, level, and direction. What is ironic, of course, is that China, occupant of the FBI’s Top FX Hoodlum List, was supposed to be out all week. So much for the much hoped for respite from CB shenanigans. At this point, Macro Man is wondering why he or anyone else bothers with foreign exchange, given these conditions.

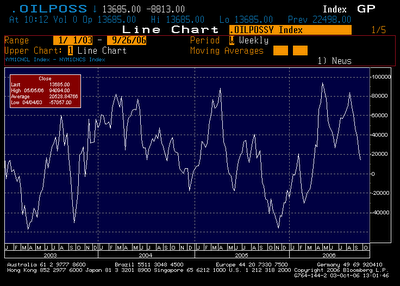

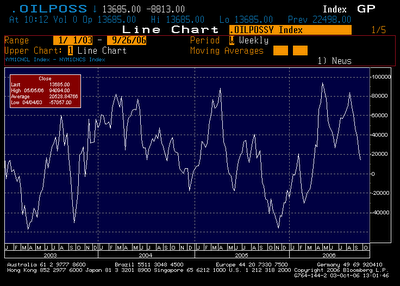

Finally, the DIA/OIH went spectacularly wrong as oil once again failed to hang onto recent gains. Long term, oil is a buy here; however, as Lord Keynes once observed, in the long run we (or, more to the point, our P/Ls) are all dead. Macro Man has little doubt that a barrel of oil with cost a Benjamin before the end of the decade. However, at the moment it’s trading as if you’ll get change from a Ulysses (S. Grant, whose face adorns a fifty dollar bill) in exchange for a barrel by the end of the year. Macro Man believes that current weakness reflects positioning; recent CFTC data suggests specs are still long, and there is no doubt a raft of GSCI-linked merchandise undergoing reverse peristalsis, applying further pressure. Therefore, he sticks with the volatile DIA/OIH spread for the time being, though price action in the latter below 120 will warrant reconsideration.

All in all, it’s not much fun at the moment. We can only hope that earnings season brings a resolution to the current period of low core market volatility and positional unwinds in key energy markets. Till then, it’s batten down the hatches time.

Where to begin? The bond position started going wrong well before the US data dump, with the losses picking up steam after the release of a below consensus ISM report. Of course, both construction spending and pending home sales were higher than expected (and positive); given the degree to which the ‘US hits a brick wall’ bandwagon has hitched itself to the collapse of the housing market, one might have reasonably expected the bond market to sell off on the back of this relatively cheery news. Instead, markets appeared to react (or predict- more on this later) a below consensus ISM, with a particularly sharp decline in prices paid. Why anyone should be surprised that the price component of the survey fell after 25% declines in the prices of crude and gasoline is perhaps a question for a sage on top of a mountain; nevertheless, this provided a handy ex post rationale for the bond market rally.

But that’s not all that went wrong yesterday. The dollar sold off hard 45 minutes before the 3pm data fest, dragging even the lowly kiwi substantially higher. The contemporaneous explanation was a rumour of a sub-50 ISM (in which case, why didn’t the dollar and yields rally after the 52.9 release?), but it doesn’t really hold water. Rather, the real answer lies with that nemesis of foreign exchange traders everywhere: emerging market central banks. Ex post, it is quite clear that a number of central banks sold dollars in exchange for euros, sterling, and yen some 45 minutes before the US data dump. Why? Who knows, and there’s the rub with foreign exchange markets. They are being increasingly driven by central bank flows, which often appear to be fairly arbitrary in their timing, level, and direction. What is ironic, of course, is that China, occupant of the FBI’s Top FX Hoodlum List, was supposed to be out all week. So much for the much hoped for respite from CB shenanigans. At this point, Macro Man is wondering why he or anyone else bothers with foreign exchange, given these conditions.

Finally, the DIA/OIH went spectacularly wrong as oil once again failed to hang onto recent gains. Long term, oil is a buy here; however, as Lord Keynes once observed, in the long run we (or, more to the point, our P/Ls) are all dead. Macro Man has little doubt that a barrel of oil with cost a Benjamin before the end of the decade. However, at the moment it’s trading as if you’ll get change from a Ulysses (S. Grant, whose face adorns a fifty dollar bill) in exchange for a barrel by the end of the year. Macro Man believes that current weakness reflects positioning; recent CFTC data suggests specs are still long, and there is no doubt a raft of GSCI-linked merchandise undergoing reverse peristalsis, applying further pressure. Therefore, he sticks with the volatile DIA/OIH spread for the time being, though price action in the latter below 120 will warrant reconsideration.

All in all, it’s not much fun at the moment. We can only hope that earnings season brings a resolution to the current period of low core market volatility and positional unwinds in key energy markets. Till then, it’s batten down the hatches time.