Markets appear to be approaching put up or shut up time. Bonds are trading close to top of the recent range, with a deep inversion to cash in the dollar bloc. To get a substantial further rally, we probably need to see the sort of data that would prompt the Fed to consider cutting interest rates. Cue tomorrow’s payroll data, an obvious source of a potential change in Fed view. Macro Man remains relatively upbeat, or else he wouldn’t be short 200 Treasury futures. Nevertheless, given that the standard error of the data is now greater than the underlying trend, there is ample chance of a statistical quirk that produces an outcome of zero or below. Moreover, the volatility surrounding the labor force statistics could easily prompt an unemployment rate uptick to 4.8.

Now, Macro Man would be willing to look through this data, but he suspects that the market would not. Moreover, fresh on the heels of today’s poor productivity data, there is every likelihood that the US economy ‘playa haters’ try and press their bets. Certainly, a downward revision to US potential GDP growth suggests the need for a more activist monetary policy (in both directions) moving forwards until the Fed feels a degree of comfort in ‘getting to know’ the lower-productivity (and thereby more inflation-prone) economy.

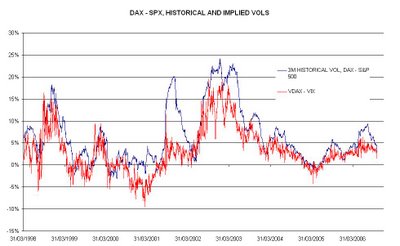

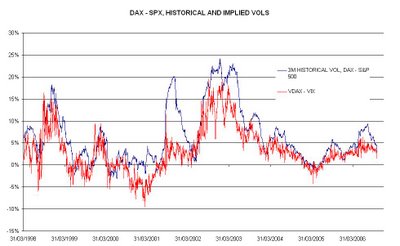

All of this, of course, is a recipe for higher volatility. As such, Macro Man has been interested to see a rise in the implied volatilities of equities, bonds, and currencies this week. Perhaps this is simply a reflection that vols have gotten too low to sell; however, it could also imply that market risk takers are finally getting fearful or greedy enough to act. Given that implieds remain extremely low by historical standards, low-delta lottery tickets provide strikes that are actually not terribly far away from current levels. With the SPX threatening to break support, Macro Man fancies some low-delta index puts. As noted earlier in the day, he bought some Dec DAX 5900 puts at 24.5. Why DAX? Well, the DAX is typically a higher volatility index than the SPX; since 1998, the 3m annualized historical volatility of the DAX has been 6.6% higher on average than that of the SPX (current observation is DAX vol higher by 3.3%). The VDAX, meanwhile, has averaged only a 3.3% premium over the VIX. Even adjusting for the slightly different maturity profiles of the two indices, it appears that DAX options are chronically underpriced vis-à-vis SPX options. With the VDAX currently pricing a scant 1.5% premium over the VIX, lottery tickets are cheapest on the German index.

Now, Macro Man would be willing to look through this data, but he suspects that the market would not. Moreover, fresh on the heels of today’s poor productivity data, there is every likelihood that the US economy ‘playa haters’ try and press their bets. Certainly, a downward revision to US potential GDP growth suggests the need for a more activist monetary policy (in both directions) moving forwards until the Fed feels a degree of comfort in ‘getting to know’ the lower-productivity (and thereby more inflation-prone) economy.

All of this, of course, is a recipe for higher volatility. As such, Macro Man has been interested to see a rise in the implied volatilities of equities, bonds, and currencies this week. Perhaps this is simply a reflection that vols have gotten too low to sell; however, it could also imply that market risk takers are finally getting fearful or greedy enough to act. Given that implieds remain extremely low by historical standards, low-delta lottery tickets provide strikes that are actually not terribly far away from current levels. With the SPX threatening to break support, Macro Man fancies some low-delta index puts. As noted earlier in the day, he bought some Dec DAX 5900 puts at 24.5. Why DAX? Well, the DAX is typically a higher volatility index than the SPX; since 1998, the 3m annualized historical volatility of the DAX has been 6.6% higher on average than that of the SPX (current observation is DAX vol higher by 3.3%). The VDAX, meanwhile, has averaged only a 3.3% premium over the VIX. Even adjusting for the slightly different maturity profiles of the two indices, it appears that DAX options are chronically underpriced vis-à-vis SPX options. With the VDAX currently pricing a scant 1.5% premium over the VIX, lottery tickets are cheapest on the German index.

Elsewhere, Macro Man won the office pool on today’s ECB press conference; he predicted that the word ‘vigilance’ would be the fifth word in the newswire headlines. That Trichet was hawkish should come as no surprise; nor should it shock even he is relatively balanced next month. The key signpost for ECB policy will likely be the January press conference, where the absence of the word ‘vigilant’ would be taken by the market as signaling a pause.

MOF currency guru Watanabe once again fired a shot over the bow of yen shorts by repeating that the yen should not be weak given Japan’s recovery (tell that to Mrs. Suzuki and co., Watanabe-san!) The comment was good for a half a percent in USDJPY and EURJPY. Macro Man was amused to see a few institutions note that he was ‘attacking’ USDJPY longs; curious, given that the yen is actually stronger versus the dollar on the year. Nevertheless, he has to acknowledge that the comments from the MOF are starting to appear with distressing regularity. Therefore, he looks to sell 10 million EUR/JPY one month forward at 150 spot basis. The yen long should partially hedge the $ calls, and with central banks reportedly offering EURUSD over the last 24 hours, perhaps euro upside is limited. Perhaps the greatest risk that the nascent rise in volatility peters out is that Asian CBs once again quash any potential trend in currencies and bonds. Truly, Macro Man would like to pin some tail risk on those donkeys....

MOF currency guru Watanabe once again fired a shot over the bow of yen shorts by repeating that the yen should not be weak given Japan’s recovery (tell that to Mrs. Suzuki and co., Watanabe-san!) The comment was good for a half a percent in USDJPY and EURJPY. Macro Man was amused to see a few institutions note that he was ‘attacking’ USDJPY longs; curious, given that the yen is actually stronger versus the dollar on the year. Nevertheless, he has to acknowledge that the comments from the MOF are starting to appear with distressing regularity. Therefore, he looks to sell 10 million EUR/JPY one month forward at 150 spot basis. The yen long should partially hedge the $ calls, and with central banks reportedly offering EURUSD over the last 24 hours, perhaps euro upside is limited. Perhaps the greatest risk that the nascent rise in volatility peters out is that Asian CBs once again quash any potential trend in currencies and bonds. Truly, Macro Man would like to pin some tail risk on those donkeys....