* The OIH looks set to open through the 140 offer for $2.5 million. Macro Man moves the offer to 142, but will go to market an hour after the NYSE opens if the retail crowd haven't paid up. Macro Man has been interested to observe comments that 'big oil' might be in trouble with a Democrat-controlled Congress. Clearly, the market does not share his dim view on the abaility of mixed party government to accomplish anything, good or bad.

* Macro Man has also heard conspiracy theories that the Bush/Cheney cabal engineered the decline in energy prices over the late summer in an attempt to bolster the Republicans' electoral fortunes. This, of course, begs the queston of which sinister entitity pushed crude from $60 to $78 during the spring and early summer?

* US trade figures were, surprise surprise, better than expected as lower oil imports spurred a decline in imports. The ex-petroleum trade balance has now flatlined for two and a half years.

* Elsewhere, Japanese bank lending disappointed, with the y/y chart starting to look an awful lot like it has peaked. Macro man is starting to really like the idea of buying JGBs on dips. Watch this space.

* The market has once again tried to sell the AUD hard, but the 'invisible hand' of you-know-who is reportedly still on the bid.

* From the 'You wanna see a housing bubble? I'll show you a housing bubble, mate' file: over the last two weeks, the UK press has been filled with stories such as:

- Dramatic rise in requets for aid in dealing with debt from the Citizens' advice bureau

- High street banks and building societies advertising their willingness to lend five times joint income on mortgages

- The highest level of repossessions since 1993, both in absolute terms and as a percentage of oustanding mortgages

- Grocery stores offering 52 year mortgages

The BOE hiked as expected today, but at some point buying short sterling upside is gonna look awfully attractive, if the last six months' price action in eurodollars are anything to go by.

* Macro Man has also heard conspiracy theories that the Bush/Cheney cabal engineered the decline in energy prices over the late summer in an attempt to bolster the Republicans' electoral fortunes. This, of course, begs the queston of which sinister entitity pushed crude from $60 to $78 during the spring and early summer?

* US trade figures were, surprise surprise, better than expected as lower oil imports spurred a decline in imports. The ex-petroleum trade balance has now flatlined for two and a half years.

* Elsewhere, Japanese bank lending disappointed, with the y/y chart starting to look an awful lot like it has peaked. Macro man is starting to really like the idea of buying JGBs on dips. Watch this space.

* The market has once again tried to sell the AUD hard, but the 'invisible hand' of you-know-who is reportedly still on the bid.

* From the 'You wanna see a housing bubble? I'll show you a housing bubble, mate' file: over the last two weeks, the UK press has been filled with stories such as:

- Dramatic rise in requets for aid in dealing with debt from the Citizens' advice bureau

- High street banks and building societies advertising their willingness to lend five times joint income on mortgages

- The highest level of repossessions since 1993, both in absolute terms and as a percentage of oustanding mortgages

- Grocery stores offering 52 year mortgages

The BOE hiked as expected today, but at some point buying short sterling upside is gonna look awfully attractive, if the last six months' price action in eurodollars are anything to go by.

2 comments

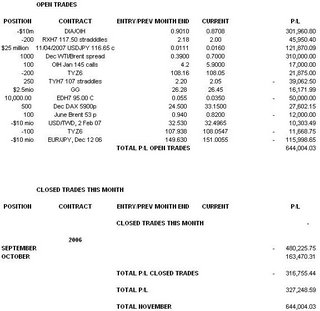

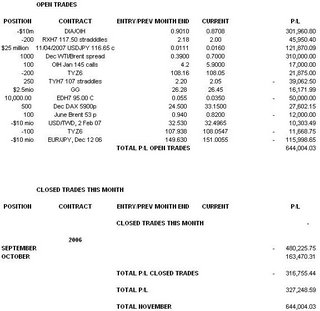

Click here for commentscheck your px for the Dax Dec 5900p on Nov 8 P&L. It should be closer to 13 not 33

ReplySo it is....obviously a problem with the Bloomberg feed. Will remedy in the next update. Thanks for highlighting it.

Reply